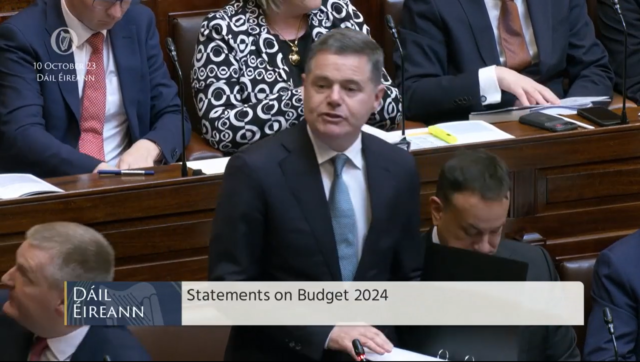

Ireland’s 2024 Budget aims to improve the economy and citizens’ lives with increased spending, one-time payments, and tax reductions. Finance Minister Michael McGrath and Public Expenditure Minister Paschal Donohoe have jointly presented the plan.

Finance Minister Michael McGrath announced a €14 billion spending package, including core spending, tax hikes, and non-core expenditure. Public Expenditure Minister Paschal Donohoe introduced measures to reduce household energy costs, including energy bill credits and lump sum payments for Fuel Allowance and Living Alone Allowance beneficiaries.

Ireland’s 2024 Budget: Focusing on Tax Cuts

The 2024 Budget outlines a series of comprehensive tax Cuts:

- Introduction of a personal tax package valued at €1.3 billion, translating to an estimated increase of €800 per working individual.

- Augmentation of personal, PAYE, and earned income tax credits from €1,775 to €1,875 — an increase of €100.

- Increase in the Standard Rate Band by €2,000 to €42,000, altering the threshold at which earners start paying the higher income tax rate.

- Adjustment of the lower 2 percent rate of Universal Social Charge (USC) to apply to earnings up to €25,760, an increase of €2,840.

- Reduction of the higher rate of USC for earnings between €25,760 and €70,044 by 0.5 percent to 4 percent.

Additional measures in the tax package include:

- Increase the home carer and single-person child carer tax credit by €100.

- Rise of €200 in the incapacitated child tax credit.

- Extension of the USC concession for medical card holders earning less than €60,000 per year by two years, valid until the end of 2025.

Enhanced Support for Welfare Recipients and Pensioners

The 2024 Budget introduces a permanent increase of €12 to weekly welfare and pension payments. This increase is supplemented by the regular Christmas Bonus paid in early December, a January Bonus payment to qualifying social protection beneficiaries, and a range of lump sum payments, including €200 for the Living Alone Allowance, €400 for the Carers’ Support Grant, and €300 for the Fuel Allowance payment, among others.

Helping Families and Children

The government has also promised a 25 percent reduction in childcare costs starting September 2024. In addition, a double child benefit payment of €280 per child will be paid before Christmas, and a double payment of the Foster Care allowance.

Extra measures to support families include the introduction of free schoolbooks at Junior Cycle in secondary schools, halving college fees for undergraduates from families earning less than €100,000, and a fee waiver on school transport services for another year. Furthermore, the hot school meals program will be expanded to include 900 additional primary schools by April 2024.

Implications for Mortgage Holders, Landlords, and Renters

A €125 million measure is available for principal private residences with outstanding mortgage balances between €80,000 and €500,000 as of December 31, 2022. It offers a 20% tax relief, capped at €1,250 per property, to homeowners affected by interest rate hikes aimed at controlling inflation.

Approximately 160,000 people can benefit from this program. Paschal Donohoe proposed further payments for mortgage holders through the Department of Social Protection, details of which will be determined post-budget. The rental tax credit for renters is set to increase from €500 to €750.

Parents can now claim credit for their children’s full-time accommodation while studying, retroactive to 2022-2023.

Landlords benefit from a sliding scale tax break of €600-€1,000, increasing annually through 2027. Vacant property tax will increase from 3 to 5 times the Local Property Tax rate to encourage more properties for rent or sale.

The Help-to-Buy scheme has been extended to 2025, allowing applicants for local authority affordable purchases to avail of it. The Residential Zoned Land Tax liability date is postponed by a year to review maps and further engagement.

Energy Credits

The government has announced a series of energy credits. Households are set to receive three energy credits of €150 each, paid between the end of this year and April of the following year. This move is designed to alleviate the pressure of rising energy costs on households. The lower 9 percent rate of VAT on energy products has also been extended for an additional 12 months.

Support for Businesses, Workers, and Farmers

The government has announced a €250M package to help SMEs impacted by high energy costs. Businesses will receive a one-time grant of up to 50% of their rates. Angel investors will benefit from a tax break on gains up to twice the value of their investment when investing in SMEs, fostering innovation and economic growth.

In summary, including:

– Increase in the minimum wage to €12.70 from January

– Significant increase in the banking levy to €200 million

– Boost in R&D tax credit from 25% to 30%

– Increase in Employment Investment Incentive Scheme’s limit to €500,000 for four-year investments

– Extension of upper age limit for retirement relief from 65 to 70

– Extension and expansion of the Key Employee Engagement Programme until 2025

– Increase in the cap on projects eligible for Section 481 tax credit for filmmakers to €125 million

– Over €100 million support for the beef and sheep sectors in the agricultural sector

– Additional €9 million for tillage farmers and

– Increase grants for new tanks importing slurry to offset the impacts of ending nitrates.

Health Sector

An additional €800 million in core funding is being provided to the health service to cater to the needs of an aging and growing population. This is the smallest financing increase for some time, following a series of €1 billion-plus rises over recent years. Despite this, a health resilience fund is being established to meet the pressures caused by increasing demand and inflation.

The health budget allocation will be focused on high inflation and patient demand, suggesting limited room for new measures. However, the government has set aside €100 million for new measures to maintain the current level of services, a reduction from €250 million allocated in the last budget.

Public Transport

The government has extended the 20 percent cut to public transport fares for adults for another year to promote public transport usage. Additionally, the qualifying age for half-price fares on public transport will now include 24 and 25-year-olds. This means a 60 percent fare cut for all people aged 19-25, making public transport more accessible for young adults.

Climate and Environment

The government has allocated €1 billion towards climate action. This includes a €100 million fund for home retrofits, which could help households save on energy bills by making homes more energy efficient. The government also invests in renewable energy and has allocated €75 million towards peatland restoration.

The plastic bag levy has been increased to 50 cents, up from 25 cents, to discourage using single-use plastic bags and encourage reusable alternatives. The Waste Recovery Levy will also be increased by €5 per tonne, promoting waste recycling and diversion from landfills.

Education

The government has pledged to create 1,400 new teaching posts focusing on special education. A 1% increase in capitation funding has also been announced, and schools will receive a once-off payment of €10,000 for primary schools and €20,000 for post-primary schools to help fund necessary digital infrastructure.

The Ireland 2024 Budget reduces the financial burden and promotes economic growth. Significantly, the comprehensive tax cuts are designed to increase the disposable income of the Irish people and stimulate the economy. This proactive approach demonstrates Ireland’s dedication to promoting its citizens’ prosperity and economic well-being.

If your clients want to benefit from Ireland’s progressive welfare and tax systems, we recommend considering the Ireland Investor Immigration Program. This program provides a path to Irish residency (Stamp 4) and access to these financial benefits. By choosing this program, your clients can invest in their future while contributing to Ireland’s thriving economy.